Best Accounting Software for Small Businesses for October 2024

David H. Ringstrom’s guide is an indispensable tool for users looking to get the most out of QuickBooks Online. With expert insight and clear instructions, it simplifies the process of setting up and navigating through QuickBooks Online, helping businesses effectively manage their finances. These are the best small business accounting books I’ve found, in no particular order. Countingup is the business current account and accounting software in one app. It automates time-consuming bookkeeping admin for thousands of self-employed people across the UK. As a result, you can set up bookkeeping and accounting systems that are efficient and easy to manage.

If you’re venturing into the world of business or simply wish to bolster your financial literacy without being bogged down by jargon, Label’s guide is your starting point. Stig Brodersen and Preston Pysh are celebrated for their insights into value investing. Their comprehensive research and adept communication skills have made them prominent figures in the financial community. Darrell Mullis and Judith Orloff have collaborated to reshape the traditional way accounting is presented. Their combined expertise has produced a work that is both educational and entertaining. Connect with Darell on LinkedIn, and engage with Judith’s expertise on LinkedIn and Twitter.

You can also try QuickBooks’ “Expert Assisted” service for free for 30 days. This service connects users with experts who can provide setup and bookkeeping help. For non-finance managers aiming to bridge the gap in their financial understanding, Sheriff’s guide is an invaluable resource.

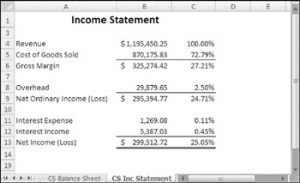

Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports by Thomas Ittelson

This guide offers a practical understanding of financial accounting basics, including crafting financial statements, tracking transactions, and understanding the importance of cash flow. With each lesson, you gain the confidence and knowledge needed to manage the finances of your small business efficiently. Ultimately, the decision will come down to your budget and the features your business needs. The authors offer a deep dive into understanding financial statements and value investing. Through exploring income statements, balance sheets, standard cost variance analysis- how it’s done and why and cash flow statements, readers will learn how to analyze and interpret financial data to identify valuable investment opportunities just like Buffett.

When this is done in the accounting software, the invoice is created, and a journal entry is made, debiting the cash or accounts receivable account while crediting the sales account. You’ll delve into the core components of managerial accounting, including cost classification, behavior, and management, budgeting processes, performance metrics, and decision-making strategies. Holtzman provides a clear roadmap to understanding how managerial accounting supports strategic planning and organizational control in any business setting. If you’re looking to grasp the intricacies of cost accounting without getting overwhelmed, this book is the perfect starting point. Whether you are a student, a small business owner, or an aspiring accountant, Boyd’s straightforward and practical approach makes cost accounting accessible to everyone.

How to Read a Financial Report by John A. Tracy and Tage C. Tracy

To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. “Financial reporting is a communications tool and should be designed to communicate useful information as clearly as possible.”

- Grasp essential accounting and finance concepts, understand financial reports, and make informed decisions based on financial insights.

- ClydeBank Business presents a straightforward and actionable guide to forming and operating a Limited Liability Company (LLC) with ease and efficiency.

- Stig Brodersen and Preston Pysh are both experienced investors and authors, with a passion for educating others about value investing.

- Josh Bauerle, a CPA with a penchant for simplifying the complex, is dedicated to financial education.

- The book navigates through fundamental aspects of managerial accounting, providing insightful explanations and practical examples.

Company

With clear steps and actionable advice, readers will learn to avoid common financial mistakes, save time and money, and ultimately build a business that not only survives do luxury goods have elastic demand but thrives. The book covers the basics of accounting, breaking down terms and calculations that are fundamental to the practice. With concise explanations, readers will grasp how accounting mechanisms work, from debits and credits to financial statements and accounting for income taxes. Choosing the best small business accounting software depends on your business’s unique needs. Of course, it’s essential to consider things like security, accessibility, and customer support options, but finding the right match means assessing your business’s specific requirements.

For anyone struggling with financial statements, this book turns seemingly intimidating accounting concepts into comprehensible knowledge. It’s a practical tool for small business owners aiming to get a handle on their company’s financial reports accounts receivable definition without getting bogged down in accounting technicalities. Additionally, many Patriot users rave about the quality of its customer support, the ease of setup, and the overall ease of use. We chose FreshBooks as one of the best accounting software programs for small businesses because it offers simplicity, strong invoicing, proposals, and good customer support.

With all essential accounting features, positive customer reviews, and a well-organized UI, it’s no wonder this free accounting software is popular. Many accounting software packages allow third-party application integrations. In a service-based business, a time-tracking application could integrate with the accounting software to add labor to a client invoice. Accounting software packages are specialized computer programs that help businesses track invoices, generate reports, and record and report financial transactions. Large firms may choose complex, customized accounting software packages that track inventory, manage accounts payable and accounts receivable, and handle payroll.