How to Find the Common Stock on a Balance Sheet in Accounting Zacks

The common stock outstanding of a company is simply all of the shares that investors and company insiders own. This figure is important because it translates a company’s overall performance into per-share metrics, making an analysis much easier regarding a stock’s market price at a given time. If there are 100 shares outstanding and you buy one, you own 1% of the company’s equity.

Understanding the Basics of Common Stock

The first-ever common stock was issued in 1602 by the Dutch East India Company and traded on the Amsterdam Stock Exchange. Over the following four centuries years, stock markets have been created worldwide, with major exchanges like the London Stock Exchange and the Tokyo Stock Exchange listing tens of thousands of companies. When buying a stock, investors don’t have to wonder exactly what type of stock it is. Preferred stock will indicate in the name that the shares are preferred.

Accounting / Journal entry for issuance of common stocks

A company maintains a balance sheet composed of assets and liabilities. Assets include what the company owns or is owed, such as its property, equipment, cash reserves, and accounts receivable. On the other side of the ledger are liabilities, which are what the company owes.

isCompleteProfile ? “Setup your profile before Sign In” : “Profile”

The primary distinction between preferred and common stock is that common stock grants stockholders voting rights, while preferred stock does not. As a result, preferred shareholders get dividend payments before regular shareholders since they have a preference over the company’s what is accounts receivable turnover ratio income. Each slice represents a share owned by investors, called common stockholders. Owning a slice means owning a part of the company, including rights to vote and earn dividends. On a company’s balance sheet, common stock is recorded in the “stockholders’ equity” section.

Initial Public Offerings

- Current and non-current assets should both be subtotaled, and then totaled together.

- In the equity section of a balance sheet, common stock shows the amount of money that holders of common stock have invested in the company.

- As noted above, you can find information about assets, liabilities, and shareholder equity on a company’s balance sheet.

- All companies must report their common stock outstanding on their balance sheet.

- If the company buys back its shares, that portion of the share is with the company, and the equity owners do not own that share.

- For example, assume a company issues 100 shares with a stated value of $10 per share, and investors purchase all 100 shares at $15 per share.

However, at its most basic level, the move simply involves crediting or increasing stockholders’ equity. For this exercise, it’s helpful to think of stockholders’ equity as what’s left when a company has paid all its debts, which is sometimes referred to as book value. Common stock tends to offer higher potential returns, but more volatility. Preferred stock may be less volatile but have a lower potential for returns.

The balance sheet includes information about a company’s assets and liabilities. Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations. Although the balance sheet is an invaluable piece of information for investors and analysts, there are some drawbacks.

Many analysts consider preferred stock to represent a hybrid of common stock and bonds. This is due to the fact that preferred stock behaves similar to a debt instrument while simultaneously being capable of appreciating in value significantly. There are several reasons why it is important to calculate common stock on the balance sheet. When a corporation sells some of its authorized shares, the shares are described as issued shares. The number of issued shares is often considerably less than the number of authorized shares. A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries.

Each investor paid $10 per share in excess of the stated value, and $10 in excess of par multiplied by 1,000 shares outstanding equals $10,000. The $10,000 additional paid-in capital and the $5,000 stated value added together, equals the total value of shares outstanding of $15,000. The asset side on the right of the balance sheet displays what the company owns, such as property, equipment, investments, cash and accounts receivable. The book value of common stock represents the total amount of equity that shareholders have in the company. To calculate the book value of common stock, subtract any dividends paid to shareholders from the total amount of capital received from issuing shares of common stock.

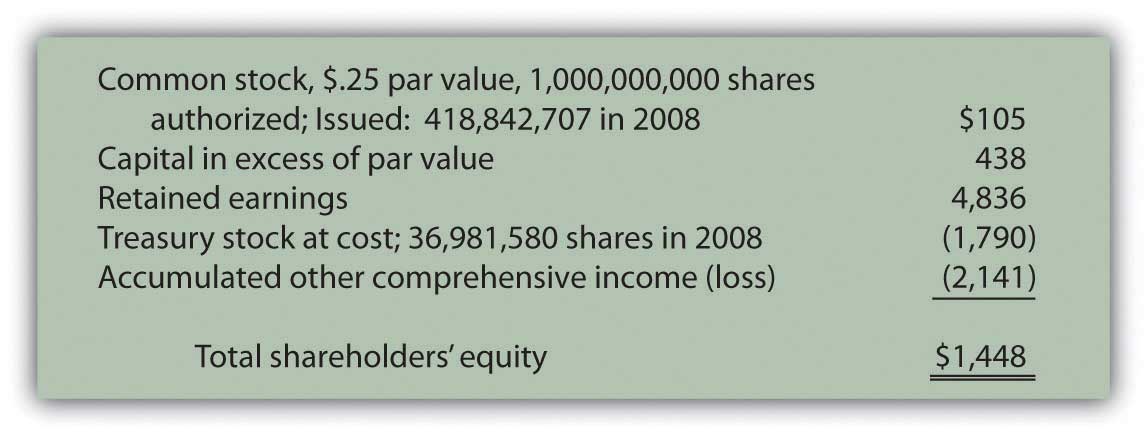

A brief review of Apple’s assets shows that their cash on hand decreased, yet their non-current assets increased. Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt. The remaining amount is distributed to shareholders in the form of dividends. Below is the snapshot of the shareholder’s equity section for the company AK Steel.